The pharmacy landscape changes in the blink of an eye, and 2023 has been no exception. This year, we’ve seen seismic shifts in legislation, industry trends, emerging pharmaceutical advancements, and more. As we approach 2024, benefit advisors and plan sponsors may be wondering what’s coming their way and how to prepare for it.

In our on-demand webinar, “2024’s Prescription for Success,” top industry experts reflect on the key insights that will shape benefit plans in the coming year. These insights will help you keep your clients informed about the market forces impacting plans in 2024.

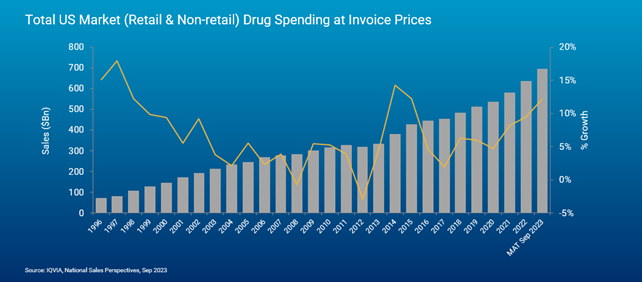

The industry saw a large spike in non-discounted prescription spending growth this year

A review of the aggregate level of invoice spending before discounts and rebates shows drug spend grew 12.1% through August 2023. Michael Kleinrock, Lead Research Director at IQVIA, a leading global provider of advanced analytics, technology solutions, and clinical research, notes a 12% growth driven by fewer patent expirations in this data. The total U.S. market drug spending at non-discounted prices hit $694 billion.

Breaking this data down to show the difference between list price and payer net spending after discounts reveals the gross to net gap, and this shows why premiums and member out-of-pocket costs have not risen as quickly.

GLP-1 inhibitors drive accelerated spending on obesity drugs

Originally developed to treat type 2 diabetes, GLP-1s continue to be prescribed off-label for weight-loss solutions. The increased usage of these drugs has led to a significant rise in expenditure, forecasted to hit $5 billion in 2024.

In the realm of obesity drugs, there’s a potential for a staggering 378% total net spending growth, equivalent to $8.1 billion. It’s important to consider the potential spillover of this spending growth into the diabetic sector.

The Inflation Reduction Act (IRA) will continue to impact issues shaping the pharmacy industry in 2024

With the IRA, the landscape for insulin pricing is undergoing a significant overhaul. The act imposes a monthly out-of-pocket cap of $35 for seniors on Medicare, and major insulin manufacturers have committed to lowering out-of-pocket costs across the board. While this brings relief to patients, it introduces a unique challenge for commercial plan sponsors.

Traditionally, plan sponsors tend to rely on the rebate system to balance the costs associated with drug coverage. However, with insulin prices decreasing, the rebates that once flowed into the actuarial model are dwindling, leading insurers and payers to cover a greater share of the costs.

While this does pose a challenge, it isn’t the be-all and end-all for commercial plan sponsors—the costs may be offset by making insulin more accessible through increased medication adherence and reduced hospitalization rates.

From the surge in obesity drug spending to the impact of the legislative changes like the IRA, 2023 has set the stage for significant changes in the pharmacy industry. It’s crucial for benefit advisors and plan sponsors to stay informed to prepare for 2024.

For a full breakdown of the key pharmacy takeaways shaping 2024, watch the on-demand webinar, “2024’s Prescription for Success.”