As discussed in Part 1 of The Brand vs Generics Battle, brand and generic manufacturers constantly face off in the ongoing battle for drug product market share. For brand drug manufacturers, inventing an innovative drug that the world has never seen before is a long and costly process. Meanwhile, modifying something old and calling it new has proven to be a simpler way for drug makers to maintain market share in highly profitable therapeutic categories.

By accessing their product marketing machine prior to the launch of a generic competitor, Brand Innovators employ multiple tactics in their attempt to maintain a competitive edge. Each of the tactics discussed in this article has one goal: preserving market share for as long as possible. Doing so paves that way for price inflation for the brand drug. After all, higher rebates, copay assistance programs, commercial advertising, and an increased sales force come at a cost.

Drug Maker Marketing Tactics

As the life of a brand patent nears its expiration, drug makers undertake a comprehensive marketing strategy that targets patients, providers, and Pharmacy Benefit Managers (PBMs). Direct-to-consumer advertising is used to influence choice through television and social media advertisements, blog posts, helpful guides, and other marketing channels. Drug coupons inundate the market to help patients reduce out-of-pocket costs of the brand drug.

Direct-to-prescriber marketing efforts influence prescribing as drug representatives inform prescribers relaying new and “improved” drug efficacy data. They detail the remaining value of their product, such as lower copays compared to a typical generic copay. Enhanced rebates paid to PBMs also help the brand stick around on a formulary longer, often leading the PBM to exclude the new generics from the formulary for a time.

See how DAW Penalties can help encourage use of lower-cost generics over brand-name drugs.

Adding New Products in the Drug Family Tree

Brand drug manufacturers also use draw-out and evergreening tactics to add to the brand drug family trees of its most profitable products. Through draw-outs, drug makers add new indications to a drug to extend the drug’s exclusivity. A common draw-out example is Humira®. Humira is an expensive biological agent that was first approved by the Food and Drug Administration (FDA) in 2002 with a three-year exclusivity period to treat one condition, Rheumatoid Arthritis. Now it is FDA-approved to treat ten different indications.

Over the years, AbbVie strategically added indications to the list to extend the drug’s exclusivity period. The latest indication was approved in 2015 for a rare skin condition, which qualified the medication for Orphan Drug Exclusivity. This designation extended exclusivity for Humira by an additional seven years.

Another competitive tactic used by brand drug manufacturers is evergreening. This occurs when drug makers make slight modifications to the drug to create a new product. Even the smallest changes to an existing product can be deemed “new” and result in a new patent. An example of this tactic occurred with two of Gilead Sciences’ HIV medications, Truvada® and Descovy®.

See how to optimize a PBM drug formulary that contains expensive drugs.

As brand drug patents near expiration, drug makers begin a wide-ranging campaign to preserve market share for as long as possible – to the detriment of plan sponsors and their members. Case in point: Gilead’s switch from Truvada to Descovy.

The Truvada & Descovy Story

Truvada and Descovy are clinically similar but with slightly different salt forms. Truvada initially was approved in 2004 for the treatment of HIV-1 infection in adults. Eventually it received approval for preexposure prophylaxis (PrEP) in 2012. Four years later, in 2016, Descovy was approved for the treatment of HIV-1, and in 2019, it too received an indication for PrEP.

Do you think this Drug Family Tree happened by coincidence? Of course not! Is it a coincidence that Descovy is priced similarly to Truvada? Most likely not.

In 2020, as Gilead anticipated a generic release to Truvada, they published results of a self-funded clinical trial comparing Descovy to Truvada. Gilead’s study confirmed that Descovy had similar efficacy as Truvada for HIV prevention. Secondary outcomes of the study also revealed that Descovy was more favorable in terms of its effects on bone mineral density and renal safety biomarkers during the 48 weeks of follow up. Gilead did not waste time in getting this information to prescribers to influence a shift from Truvada utilization to Descovy.

Observing Data Trends in Truvada & Descovy

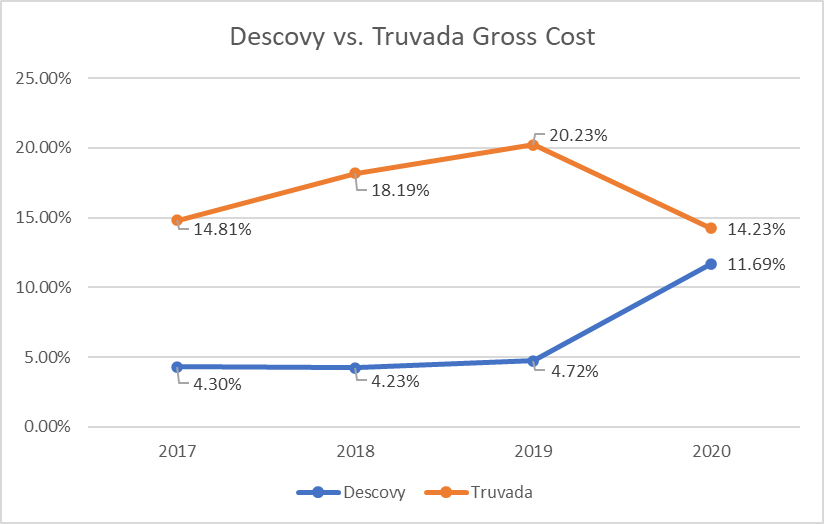

Between 2018 and 2020, RxBenefits’ clinical pharmacists observed telling signs about the market shift from Truvada to Descovy and its impact on pharmacy benefits plans. In 2018-2019, spending on Truvada increased by 2% and utilization increased by 0.7%, while Descovy utilization and spend remained flat. With the 2019 approval of Descovy for PrEP, Gilead set its marketing machine in motion. Comparing 2019 to 2020 against all HIV utilization, Truvada spending decreased by 6% with a 2% decrease in utilization. At the same time, there was a 7% increase in Descovy spending and a 3% increase in Descovy utilization in 2020 (Figures 1 & 2).

Figure 1: Descovy vs Truvada Claims Utilization (Relative to All HIV claims)

Figure 2: Descovy vs Truvada Gross Cost (Relative to ALL HIV Expenditure)

Using a data-driven approach is essential to monitoring clinical appropriateness of prescription drugs and excluding wasteful medications. Data also enables pharmacy benefits plans to target and guard against the types of ‘marketing-machine-activated’ brands discussed above.