What You’ll Learn

- Changes in the drug product mix and the impact on pharmacy benefits plan sponsors

- How specialty drugs shifted pharmacy benefits spending

- How vertical integration changed the role of PBMs

Video Transcript

I’ve been in the pharmacy practice for about 17 years. Roughly 10 to 15 years ago, we just started to specialty drugs come to the market. At one time, there never used to be any type of cancer medication that was given outside the hospital setting and through anywhere but an IV. Now we have oral cancer medications, and that’s on top of certain biologic medications for more common disease states, like rheumatoid arthritis, Crohn’s Disease, ulcerative colitis, and others. We’re just seeing more and more drug manufacturers entering that market.

How Has the Prescription Drug Market Changed?

There has been a shift in production from brand to generic, and now to this new sector of specialty medications that has changed the drug product mix. These medications are costing on average between $3,500 to $5,000. It’s dramatically shifted the pharmacy benefits plan cost breakdown. It used to be that 80% of plan costs was attributed to brand-name drugs, and 20% of costs were driven by generics. Now, that brand drug bucket has been split up and a little bit of the generic drug bucket. We’re seeing specialty by itself is roughly 45% to 60% of all plan costs, and traditional brand drugs and generics make up the remainder.

This dramatic shift resulted in the need for employer-based plans to think about how they can mitigate their specialty expenses effectively over time. Over the past two to three years, some new avenues have emerged, and traction has been made, to help employers mitigate those expenses.

Within the last two decades, specialty drugs entered the market and caused a radical shift in prescription drug spending and how PBMs manage pharmacy benefits.

How Has the Pharmacy Benefits Industry Changed?

From my perspective, pharmacy benefits managers (PBMs) used to be a means to an end, as a claims processer. It was the basis behind which you could get a quick paid claim at the pharmacy to where the member could know exactly what they are going to pay, and they pay it out. Now, it’s evolved to where they are more integrated than they used to be.

The PBMs now own or are owned by insurance carriers. For instance, UnitedHealthcare owns OptumRx, which is a PBM. CVS Caremark is a PBM and bought Aetna, which is a carrier, and so they are now CVS-Aetna. And Cigna-Express Scripts, where the stand-alone PBM Express Scripts has merged with Cigna.

This vertical integration in the industry has created a data-share behemoth where these entities know exactly what underwriting they need to do and what pricing they need to meet their goals, which are aligned to their shareholders. It’s much different in how they have gone from being simple claims processors to huge healthcare companies. With their type of size and scope, however, there has to be some level of accountability. They are looking at what’s in their interest, not so much in the interest of the self-insured employer-sponsored plan.

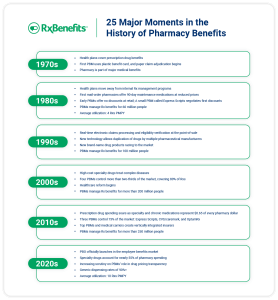

Download the industry timeline graphic to learn more about important milestones in pharmacy benefits over the years.