Top 3 Things You’ll Learn

- What is driving the increased cost of specialty medications

- Disease states most likely to be treated with specialty drugs

- How to prepare clients for possible future impact

Specialty drugs can treat or cure members with chronic, rare, and complex conditions, but they can also come with a hefty price tag, and the drug pipeline is dominated by specialty medications in development. In fact, nearly 80 percent of new drug introductions are considered specialty medications. In 2021, there were roughly 40 specialty medications added to the market. 1

With a growing pipeline of high-cost specialty drugs and the undeniable influence of pharmaceutical advertising, the majority of employers will find themselves facing the impact of specialty claims in the coming years. With one in 10 Americans having some type of rare disease, benefits advisors need to prepare their clients for the future and keep their eye on the specialty drug pipeline.

What is driving the increased cost of specialty medications?

You can see the growing impact of specialty drugs on the average cost of new medications. In recent years, nearly half of new drugs were priced at more than $150,000 per year, while in 2008 less than 10% of new drugs were introduced at this price level. 2

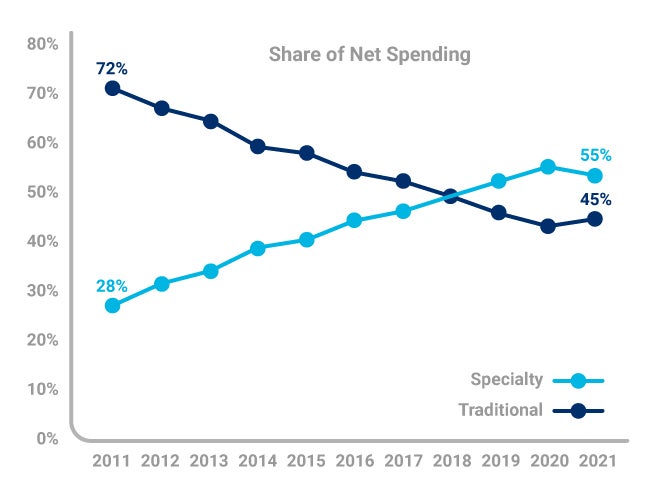

Specialty medicines now account for 55% of spending, up from 28% in 2011.2 The amplified costs for these breakthrough medications are driven by a need for special handling, close oversight from specialists, and development and manufacturing costs to treat relatively small populations. We will continue to see spending grow on these drugs in the next five years, particularly for autoimmune disorders, oncology, HIV, and multiple sclerosis patients.

The scale of savings could be tipped by more biosimilars entering the market, savings from these drugs that closely mimic an existing, approved biologic are projected to be $35 to $40 billion in 2025.3

Unfortunately, another factor driving cost is a lack of information. Doctors are often unaware of what the manufacturers are charging, and the member is generally concerned about the copayment or coinsurance amount, not the actual cost charged to the plan.

With over $6.5 billion dollars spent on advertising high-cost medications directly to members, the pharmaceutical companies are another factor driving the growing sales of specialty drugs. In addition to consumer advertising, they send their drug reps into doctor’s offices to drive uptake among prescribers. They also provide them with samples and coupons for consumers that lower or eliminate the copay, though the payer is still left to cover most of the cost of these very expensive drugs.

What can you do to prepare your clients for a specialty claim?

For employers, understanding specialty claims and costs can be difficult because definitions and drug lists vary between pharmacy benefits providers and contracts. Another factor adding to the confusion for your clients is that these claims may be covered under the pharmacy benefit or the medical benefit. In fact, up to 50% of specialty drug spend may be through a medical benefit.

As the client’s trusted source for making decisions, you need to understand the definitions, specialty drug lists, and limited distribution drug lists for each contract.

When quoting rebates relative to specialty medications, the PBM may include or exclude certain types of medicines (for example limited distribution drugs) from that rebate guarantee, and that qualification may change depending on how the drug is dispensed. If the pharmacy benefits contract includes different guarantees for different specialty medications, make sure their guarantees align with the client’s member utilization. Understanding contract language regarding specialty is key to maximizing specialty rebates.

Work with a trusted clinical partner to help manage high-cost and specialty drugs. This partner should be able to design a strategy based on the group’s specific claims data, use clinical expertise to identify appropriate next steps, and use client-specific data to uncover opportunities to save money while making sure members are getting the care they need.

There’s no hiding from the growing specialty pipeline and the high-cost claims that will impact your client’s bottom line. As a benefits advisor, it’s important to stay informed about the latest in specialty medication releases and to find partners who can help you navigate these waters.

Sourcing

FDA Novel Drug Approvals for 2021: https://www.fda.gov/drugs/new-drugs-fda-cders-new-molecular-entities-and-new-therapeutic-biological-products/novel-drug-approvals-2021

IQVIA Institute, March 2022 https://www.iqvia.com/

IQVIA Biosimilars 2020 – 2024 https://www.iqvia.com/insights/the-iqvia-institute/reports/biosimilars-in-the-united-states-2020-2024